Edgeworth Partners

When you become a client of Edgeworth Partners you embark upon a journey that will last for a long time. The majority of our clients have been utilising our services for over 15 years. The reason they stay so long is best summed up by one of our long-term clients

“Edgeworth Partners offer an outstanding service, far more than just simple accountancy. I’ve experienced practical, considered & individual advice to take my business to the next level.” _ Russell Wright – Oceanview Physiotherapy

Sure, we do accounting, Business Advice and Taxation and we integrate our Financial Planning into the overall service offering; but we are not backward-looking processors of data. We genuinely are an active participant in your success with tailored Strategy, Structure and Implementation processes that really work – for you.

We are not just number one in numbers we are “Number One in People”.

About Us

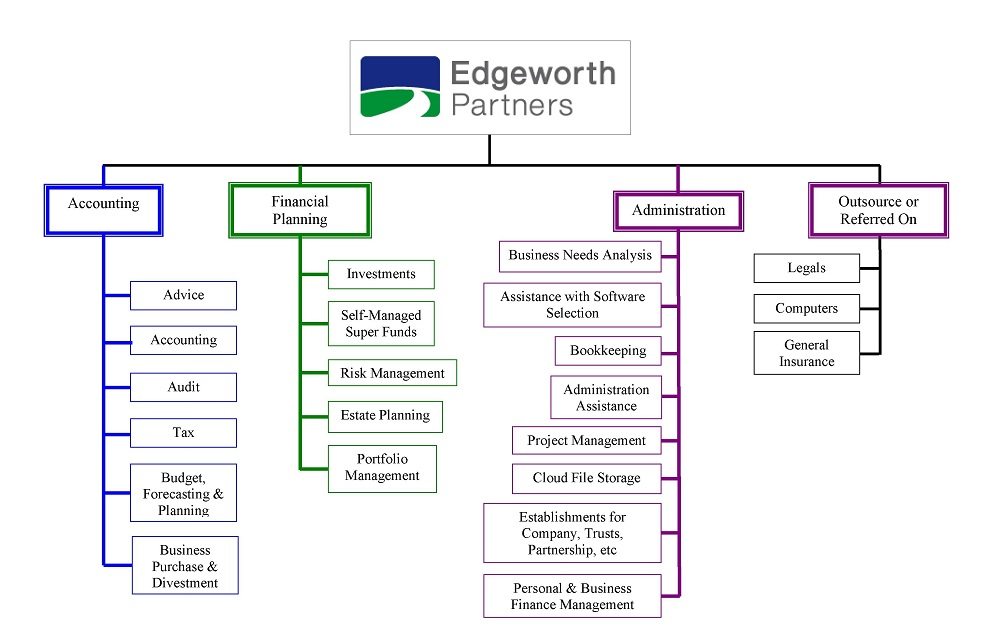

Edgeworth Partners Pty Ltd is a multi discipline practice offering Accounting and Financial Planning advice to a range of clients including Family Groups, Business Owners, Professional and Executive Clients.

Edgeworth Partners Pty Ltd was established in 1987 by our Senior Partner Peter Dugan. Peter is an active adviser in our firm and offers Business, Accounting and Financial Planning advice across the practice.

Accounting

We have qualified and experienced accountants on our staff and they are dedicated to providing timely, accurate and cost-efficient accounting and tax compliance services to our clients.

Our approach

We start with software selection and system design, to make sure you are using the right tools for the job. For small and medium businesses,we can help with bookkeeping, payroll and BAS services. When Clients choose to do the bookkeeping themselves, we provide monitoring, guidance and assistance, through our accounting services.

Whilst compliance services are necessary, we are not a backward-looking firm; just producing information about how things went in the past is not where we feel we can add the most value to your financial affairs. We are active participants in the process of your success.

We engage in Strategy, Structure and Implementation of forward-looking activities that are tailored to your particular circumstances and the status of your business life. Our client interaction reflects 30 years of dealing with small and medium business, family groups and individuals to make sure all relevant matters are considered each year. We concentrate on the correct use of trusts, companies and self-managed superannuation funds using simple but effective strategies to produce the overall outcomes that are specific to our Clients’goals and objectives.

Your resources

You will be allocated a Partner of our firm and the day to day aspects of our accounting service will be facilitated by our Practice Manager,who coordinates the allocation of Accountants, Service and Administration staff. The financial planning process is dovetailed in to the overall relationship and implements the detailed statements of advice prepared for each Client.

Our fees

Our fees are based around our Scope of Works and Engagement letters. Our rule is “no fee without the Client’s agreement”. At the start of each financial year or major task, we cost and discuss the work and fee structure with you. This creates a contract of our service levels and we proceed on that basis.

Our Service

×

Useful Resources

Edgeworth Partners’ Qualities

Send us a message

Insights on the 2024-25 Federal Budget

The Power of Employee Benefits to Businesses

Understanding Insurance in Your Self-Managed Superannuation Fund

Home is More Than Just a Place to Live, It’s a Smart Investment